Globally and in the United States, online shopping has become more popular than in-person shopping. Technology is transforming the majority of user-facing online businesses during 2023. Providing easy checkout options along with the best, safe, and most diverse online payment methods is key.

People are choosing the comfort of purchasing online over going out to buy things personally. That’s why brick-and-mortar shops must build online shopping portals to facilitate more users. So, it is beneficial for both users and businesses.

Today, it is necessary to make the shopping experience for customers easy and smooth. The simplicity of order placement, sales of products/services, payment processing, and user onboarding make a great difference. Likewise, it is not just for businesses selling products online, but companies offering services online.

Table of contents

Key Takeaways

Ever since the Coronavirus pandemic hit, the eCommerce industry is facing a massive turnover. Business dealings, product sales, and service bookings are significantly changing with online payment methods. With the ever-growing popularity of online shopping, product/service sales usually take place over the internet.

Presently, most businesses will completely rely on electronic transactions. Online retail, fashion/apparel, education, and many other industry sectors are reforming. In the future, these trends will gradually continue to grow.

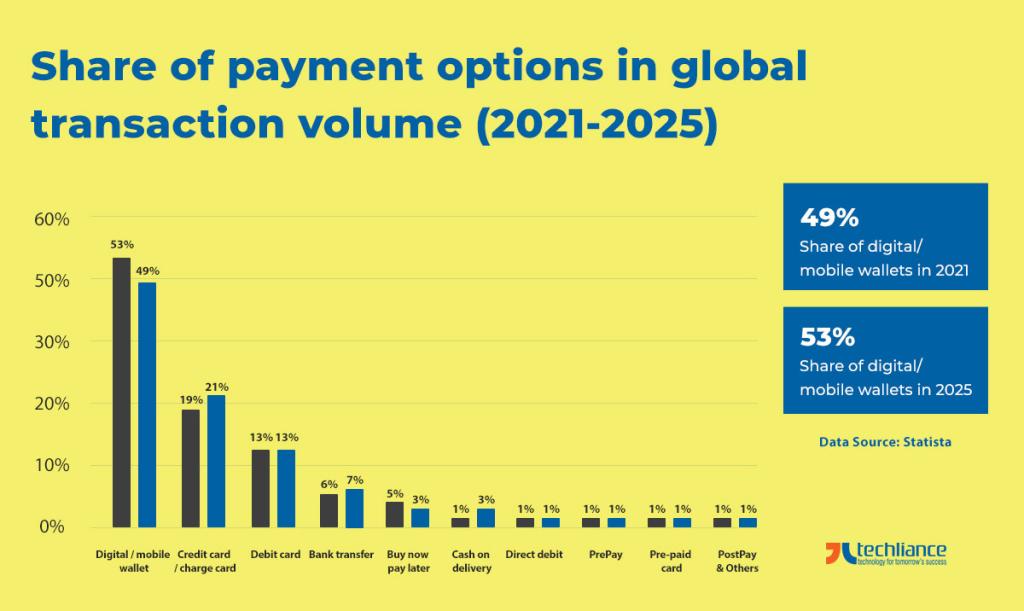

Digital/mobile wallets were the most used payment modes with 49% of the total eCommerce transactions worldwide in 2021. Statista forecasts their share to rise to 53% by 2025. Credit cards and debit cards are second and third in high-demand payment options.

These are some vital key takeaways of online payment methods to consider.

- While deciding the payment methods for your target audience, keep in mind their culture, country, continent, and demographical locations.

- Since the behavior of people changes depending on where they belong.

- When your users have the flexibility of different online payment methods to choose from, sellers will have more sales.

- If the payment options are limited, chances are that the seller will have a huge number of abandoned carts.

- People are very much anxious about their personal information and details. Many users avoid risking their details online due to the fear of hackers. Therefore sellers should provide options that are safe to deal with, for the customers.

8 payment modes for eCommerce to get more online sale

Here are different payment methods which sellers can offer to let the customers enjoy a great shopping experience.

- Electronic wallets

- Credit card

- Debit Card

- Cash on delivery (COD)

- Bank transfer

- Online payment gateways

- Payments through apps

- Cryptocurrency

Let’s dive into the rewards these payment methods bring to users through 2023.

Electronic wallets

Also known as e-wallets, electronic wallets offer a fast and quick service. The shoppers link their bank accounts to e-wallets. While making payments, they are linked to the e-wallet page, where they can proceed with the buying process.

A survey by personal statement writers found electronic wallets require only one or two clicks to complete the checkout process. That’s what makes these the most used payment method in current days. Google Pay, Samsung Pay, Apple Pay, and AliPay are among some of the most used electronic payment methods.

These mobile/digital wallets save you valuable time. Since you are not required to put in your credit and debit card information every time you purchase a thing. Moreover, electronic wallets have left behind other online payment methods in popularity.

Credit card

Shoppers can conveniently and easily use credit cards to buy products online. The customer only has to put in their credit card details to purchase their products. That’s what makes credit cards convenient for online transactions.

Many banks provide discounts and special rewards for using credit cards. By utilizing a credit card, customers can increase their credit scores. Later, they can use these scores to buy a thing of their choice in quick selling or other shopping mediums.

Credit cards are secured by their card verification value (CVV). It makes credit cards safe to use for online purchasing. You can detect financial fraud by comparing the customer’s information and the CVV digits.

Debit card

The popularity of debit cards is quite similar to credit cards. Budget-conscious customers can use debit cards to make payments from the savings in their bank accounts. Debit Cards are the best option for people who can’t afford to buy more than needed.

Cash on delivery (COD)

While there are countless innovative payment mechanisms, cash on delivery (COD) is still favorable among many people. A customer is made to pay at the doorstep after receiving the parcel. Thanks to COD, online orders are becoming more risk-free.

In case, the product doesn’t match the requirements of the customers, they can return it without paying for it. Many fraudulent companies operating around the world will not stand a chance to scam. As they can’t scam customers with the cash-on-delivery payment method.

Bank transfer

Since a lot of people are hesitant to put up their debit and credit card essentials for online transactions. Therefore, these users can use bank transfers as a safe and secure method. Although bank transfer is usually longer and slower than credit or debit card payments, many people still opt for it.

With the changing world dynamics, bank transfers are becoming an old-school thing. They are still more reliable, as customers have to approve each transaction. Additionally, bank/wire transfers are ideal for users who don’t have digital payment methods available.

Online payment gateways

Electronic payment gateways like PayPal, Square, and Stripe are making payment transfers easier for a long time. They form a secure and reliable link between shoppers and businesses. Accordingly, online payment gateways make the shopping experience for seasonal and other items satisfactory.

Payments through apps

With the advancement in technology and the eCommerce industry, social networking sites are not only for socializing. Many social media apps like Facebook, Instagram, and TikTok have entered the world of the online marketplace. Hence, the payments through app feature make the buying/selling process easy for people without having to leave the apps.

Cryptocurrency

There is no extra charge back and taxes on cryptocurrency transactions. Subsequently, cryptocurrency (driven by blockchain) is widely becoming a go-to payment method for many. This mode of payment is one of the best options since it has the lowest bare minimum fees.

Conclusion

Nowadays, online selling and buying are the most trending norms amongst the masses. Just in case, you are finalizing the best payment methods for your business. Make sure to do good research regarding your target audience in 2023.

What if you fail to choose a payment method according to the people you target? You are most probably not going to earn a good profit out of your business. Therefore, to reach out to a larger audience, choose your online payment methods wisely to make the most of them.

FAQs

Lastly, here are some relevant frequently asked questions (FAQs) with short answers.

Banks and financial institutions protect online payments with encryption technology. Also, they spend millions on cybersecurity measures to safeguard their systems. This makes these modes of online transactions safe for users and businesses.

Credit card and debit card payments have been the most popular payment methods globally. However, electronic wallets are conquering the online retail market worldwide now, powering more than 50% of transactions. Cash on delivery remains the safest transaction mechanism for people who hesitate to pay upfront.

Yes, it does as more is better. You should always offer your clients multiple options. Thus, they may not leave your platform due to the unavailability of payment choices.

Provide your users with diverse payment options. So that they can choose one at their convenience. Consequently, customers who are unable to pay you through a particular method; will have other options too.